Mohnish Pabrai in his highly acclaimed book ‘Dhandho Investor’ popularized the following concept:

- Investors should constantly look for mis-priced situations where loss on downside is capped while potential upside is multi-fold (Heads I win, Tails I don’t lose much).

- One must bet big when the odds are overwhelmingly in his favor.

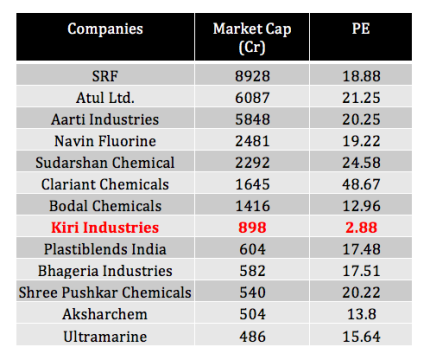

While screening for bargains in Chemicals industry (If you want to make the industry sexy, then add “Specialty” before it :-)), I accidentally stumbled upon Kiri Industries.

Background:

Kiri Industries is one of India’s largest and integrated manufacturer of dyes intermediates and reactive dyes which are used in dyeing cotton fabrics, synthetic fabrics, bed-sheets, carpets etc.

Value chain: Basic Chemicals [Oleum/Sulphuric Acid/Chloro Sulphonic Acid] —> Dyes Intermediates (Vinyl Sulphone/H-Acid) —> Reactive Dyes (Colorants for Textiles). The company is vertically integrated across the value chain from basic chemicals to reactive dyes.

I. Rapid rise (2007-2011):

Manish Kiri (2nd gen promoter with MBA from USA) took over the company. This period was marked by rapid expansion of manufacturing facilities, overseas acquisition, equity fund raising via IPO & QIP and debt binging.

- In March 2008, company came out with the IPO to raise about 56 crores. The funds was principally meant for capacity expansion of basic chemicals and dyes intermediates.

- In March 2010, Kiri industries (37.57% stake) formed a JV with China-based Longsheng group (62.43% stake) and acquired German-based DyStar from bankruptcy proceedings. The JV was based out of Singapore and raised about 100 million euro (Debt to equity of 65:35) to fund the acquisition. DyStar (Formed through the merger of dyes operations of BASF, Hoechst, and Bayer) is a leading player in dyes solutions with a 21% global market share and with sales of 800 million euro. It acquired the net assets of 291 million euro in addition to fully depreciated fixed assets of 140 million euro at replacement value. It avoided taking over all liabilities, including employees and bank liabilities in Germany.

- In November 2010, Kiri industries raised about 240 crores at the price of 590/- to fund DyStar acquisition and also expand manufacturing facilities of standalone business.

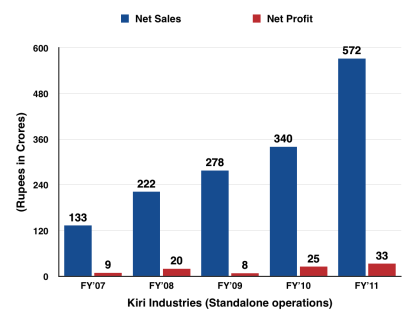

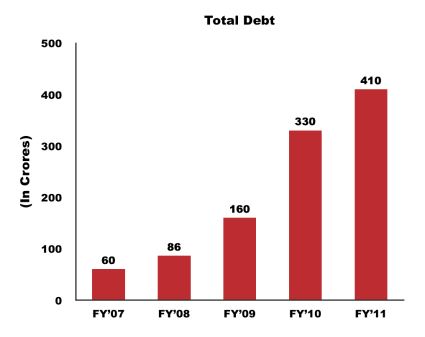

During this period, revenues of standalone operations jumped 4X to 572 crores. However, debt also jumped from 60 crores to 410 crores.

II. Hard fall (2011-2015):

- Delay in turnaround of DyStar: Initial turnaround plan was to replace high cost german manufacturing base with lost cost manufacturing in India & China and be cash positive from 2011. Management also guided DyStar IPO by Q1 CY 2013 at an international market. Even the best laid plans goes awry due to multiple factors. Euro zone crisis and resultant slowdown hit DyStar hard. Hence, Kiri Industries had to fund the company through term loans & working capital loans (around 100 crores) raised in foreign currency in FY’12.

- Derivative loss: During the Rupee crisis in 2013, Kiri Industries encountered derivative losses (82 cr) and loss on conversion of foreign currency loans to Indian currency (30 cr) following restructuring of loans by banks [Similar to many Indian firms at that time who didn’t hedge foreign currency]. All of them piled into giant debt of 750 crores!!

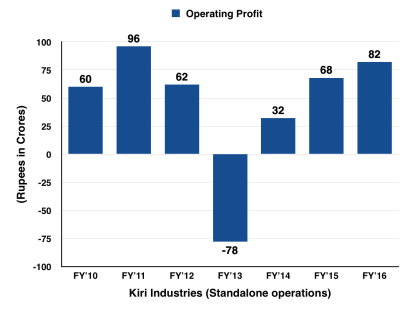

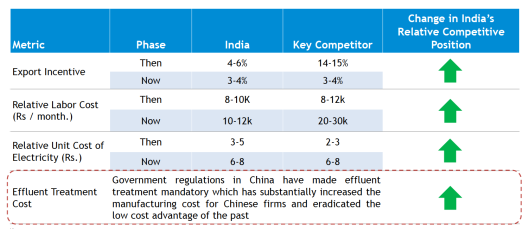

- Volatility in crude oil prices (principle raw material) and dumping from Chinese competitors [Unlike Indian counterparts, Chinese manufacturers do not have effluent treatment plant – hence they could produce at low cost] resulted in losses even at operating levels [Closest competitor Bodal Chemicals also faced similar problems – suffered both operational & forex loss].

- Corporate Debt Restructuring: Shares pledged with the lenders were dumped in the market resulting in drastic drop in promoter shareholding from 58% to 30%. Also, JV partner blocked the IPO of DyStar and thereby preventing value unlocking. Local banks also closed funding tap following the debt ballooning & operational losses. Hence, the company ran out of options and admitted into CDR.

III. Slow Recovery (2015-Present):

When the company is headed south, we investors have an option to abandon the ship and move to better investment opportunity. However, promoters does not have that luxury. His fortunes are intimately tied with the company. He has to wither the storm and do the hard grind to reach his desired destination.

- Promoter fund infusion: In FY 2015-16, promoter infused around 50 crores in 2 tranches by subscribing to 37.5 lakh warrants at 135/- per share. Consequently shareholding increased from 25 to 37%. In October 2016, board approved 35 lakh warrant to promoters at the price of 363/- which can be converted at any time during the next 18 months. At the time of allotment, promoter has to pay 25% upfront i.e. 32 crores. Promoter shareholding may jump to 44.64% at the end of the process. Warrants at both instance were priced at slight premium to the prevailing market price. As of date, they infused 80 crores along with commitment of 90 crores over the next 18 months.

- Debt restructuring by lenders: In exchange of promoter’s fund infusion, lenders agreed to restructure the debts. April 2016 announcement: “Kiri Industries Limited has executed agreements for settlement of all its debt by the end of financial year March 31 , 2016. This has resulted in significant reduction of the borrowing. The total borrowings of the company have been reduced from Rs. 853.13 crores to Rs. 410.62 crores, which is about 51.87% reduction compared to the previous financial year. The initial installments under the agreements are also paid before the end of the financial year 2015-16. Further, as per Settlement Agreements executed, the Company is committed to settle and repay majority of the balance debt during the current Financial Year 2016-17. Hence, the company has now achieved a major landmark for its shareholders by fully addressing its debt burden, which had been weighing down the Company’s performance over the past several years. On one hand the realization of its products have significantly improved, on the other hand there would be huge savings in the finance charges from the current financial year i.e. 2016-17. The debt has been addressed majorly with the asset reconstruction companies, private lenders, as well as NCD holders.”

- Tailwind for Indian dye intermediates manufacturers: Closure of chinese plant (Hubei Chuyuan – Largest player of Dyestuff in China) resulted in 2-3X increase in prices of dyes intermediates (Vinyl Sulphone/H-Acid) resulting in windfall gains. In addition, Indian dyes industry faces structural tailwind due to china’s pollution problem (See below).

Heads I win – Value unlocking in Dystar subsidiary:

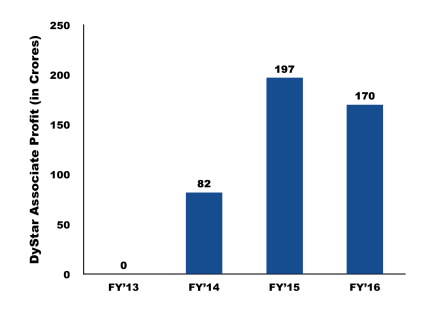

Beginning FY’14, DyStar subsidiary started to show turnaround in performance and is now generating profits consistently for the past 3 years. This associate profit from the JV gives an EPS of 70-80. Principal reason for the low PE in the screening table above is that Mr. Market ignores DyStar associate profit completely. With no access to the DyStar profit pool, Mr. Market believes that Kiri’s investment became kind of dead-end.

In June 2015, Kiri Industries initiated legal proceedings in the High Court of Republic of Singapore against JV partner Longsheng to enforce its rights as a significant minority shareholder and unlock value of the company’s share (37.37% stake) in DyStar.

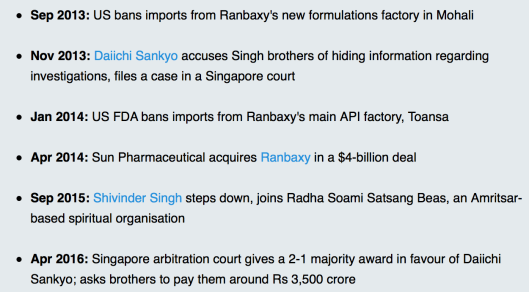

Company is hopeful of completing litigation by end of Sept’17. Based on the timeline of recent Daichi-Ranbaxy arbitration at Singapore court, I would say it is very much possible. Also remember, JV (DyStar global holdings) entity was registered in Singapore.

Daichi – Ranbaxy arbitration timeline

Best-case scenario: If Kiri Industries win in litigation, then JV partner has to purchase its 37.37% stake on the basis of court mandated independent valuation or else to liquidate DyStar and distribute assets as per investment ratio of both shareholders. Even if we assign a PE of 10-12, its 37.37% stake will yield around 2000 crores.

Worst-case scenario: Company’s investment will remain blocked till it liquidate to a 3rd party.

Tails I don’t lose much:

- Industry tailwind for the standalone operations:

[Source: Bodal Chemicals Investor’s presentation]

[Source: Bodal Chemicals Investor’s presentation]

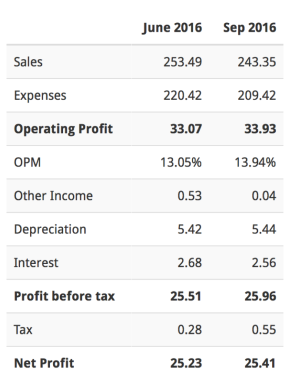

- Quarterly performance in FY’2017:

On a steady-state basis, company should yield around 70-80 crores of net profit [Note: Quarterly interest cost fell from 20 cr to 2.5 cr]. At a PE of 10-12, standalone operations of Kiri Industries should support the current valuation of 900 crores.

Management:

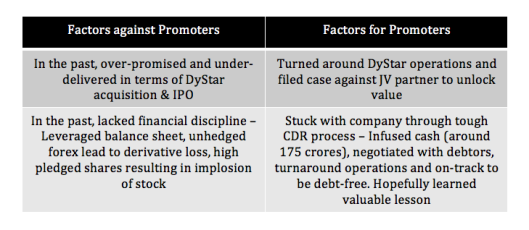

Ultimately we are partnering with promoters in a belief that they will share the proceeds with minority shareholders. Hence listed factors for & against promoters:

Concentrated bet can go wrong:

I strongly believe that few outsized bets are necessary to build a sizable corpus before switching to diversified portfolio to protect the corpus. Once a favorable odd was identified, we have to gather courage to bet big. If everything goes well, investment should conservatively yield 3X in 2-3 years time frame. If not, will incur huge opportunity costs due to the outsized nature of the bet.

Worked: Buffet invested of 40% of his fund in American express during salad oil scandal.

Went against: Bill Miller investment in Financials during 2008 crisis and Bill Ackman’s investment in Valeant pharmaceuticals.

Disclaimer: Please note that this is my investment journal. The main aim is to expose my investment thesis to the scrutiny of fellow investors and improve the process thereby. It shall not be construed as an advise to buy/sell the stock.

As per Screener https://www.screener.in/company/KIRIINDUS/

the PE is 13 and you have mentioned 2.88; why is this discrepancy

Cheers

Ajay

LikeLike

Hi Ajay,

Click consolidated numbers in the screener. 13 PE is for standalone numbers.

Regards

Jagadees

LikeLike

http://www.bseindia.com/corporates/anndet_new.aspx?newsid=60edc504-46dc-48c0-9441-10a9b7921fde

LikeLike

Dear Sir,

Thanks A lot for such a nice analysis…. May you please help me to understand below :

What exactly is litigation issue, Kiri have JV and the subsidiary is making 170Cr profit. “If Kiri Industries win in litigation, then JV partner has to purchase its 37.37% stake on the basis of court mandated independent valuation or else to liquidate DyStar and distribute assets as per investment ratio of both shareholders. ”

May you please explain in detail about this. I am not fully understanding it.

Thanks

LikeLike

Dear Neeraj,

In 2010, Germany based DyStar was bought by Longsheng group (62.67% stake) and Kiri industries (37.37%). DyStar struggled until 2013. But since then it was turned around successfully and now consistently generates profit from 2014. In FY’2016, DyStar reported around 450 Cr of profits and Kiri’s 37.37% stake will give 170 cr. But being minority shareholder, Kiri could not able to access the cash generated or intellectual property rights. Longsheng group also rejected IPO listing of DyStar. Since, JV entity was registered in Singapore, Kiri filed litigation to enforce the minority rights. Either Majority shareholder should buyout the minority shareholder or the company has to be liquidated and assets distributed between them. Through this Kiri can realize the market value of its minority stake in DyStar. Let me know if i made it clear or confused further 🙂

LikeLiked by 1 person

There can be a serious flaw in the above assumption. Let me cite an example.

Suzlon purchased some German company (not able to recall the name; it was purchased in 2008 or so). The agreement was like this that Suzlon was not able to ‘take back’ profit part from this German Company whereas it took huge debt to fund and finance this acquisition. Finally after nearly 8 years of struggling and fighting, it had to sell this venture at a substantial loss.

I am not able to understand why Kiri wants to ‘give-in’ to Chineese company. In the shareholders agreement, all these events are fairly spelt out including buy-out by any of the current shareholders including RoFR, exit options and other rights in terms of the shareholder agreement. Why it wants to offer for ‘being bought’ or assets to be liquidated. Why it cannot ‘buy’ the JV partner instead of surrendering to it.

There are many questions pertaining to this intention and options available , more particularly in terms of original shareholders agreement and rights and obligations of different JV partners.

LikeLike

Suzlon’s problem with RePower/Senvion is quite different from Kiri industries. In the case of Senvion, German law prohibits the acquirer to ship the cash out of the company.

Kiri industries problem is with its majority shareholder i.e. JV partner. When they acquired DyStar, they wanted to do IPO in 2-3 years down the line. But Chinese partner backtracked on the promise. If Kiri industries has to buy-out partner’s 67% stake, it may need around 4000-5000 crores. It is quite a sum for a 900 crore company which is just coming out of big debt related mess. If the partners can’t resolve the way forward for the company, it is natural for the company to approach Court. Lets see how the verdict pans out.

LikeLike

For further discussion and analysis, I can be reached to my personal email id: kamalgarg279@gmail.com

LikeLike

hi,

nice post…..Can u share with us which screener u r using?

LikeLike

Generally I use valueresearchonline.com or screener.in

LikeLike

Thanks. Shankar Sharma had recommend Kiri industries – http://rakesh-jhunjhunwala.in/shankar-sharma-recommends-two-micro-cap-stocks-which-are-on-the-verge-of-a-turnaround/

I stay away from his recos..

LikeLiked by 1 person

Dear Sir,

As always a succinct article. Noticed from Screener that interest expense for Jun & Sep 16 are under 3 Crores, however Mar’16 Balance sheet shows debt of INR 425 Crores. Any particular reason for this fall. I haven’t looked into this Company and hence may have missed Corp actions post March.

Sorry for the typo in the above message.

LikeLike

Hi Nikil,

According to the debt settlement agreement with the lenders, management intend to pay off most of the debt (barring 100-150 crores) in the current financial year in exchange for 50% loan waiver. Bullet payments have been worked out. If you see Q2FY’17 balance sheet, outstanding debt has been further reduced to 350 crores. Management said that interest costs will be only 10 crores per annum going forward.

LikeLike

Hi, Eeswar

Could you please update on the court case as of today.

Thanks.

LikeLike

Excellent analysis. However, Warren Buffett example of American Express purchase

is not comparable, as it applies to quality companies mispriced temporarily. The quality companies are those which have a track record of consistently high ROCE , due to a durable moat. Incidentally, there is every possibility of Indian Govt enforcing the same norms against polluting chemical manufacturers as China!

LikeLike

Indian chemical manufacturers encountered similar problem in 1996. Gujarat high court order made it mandatory to have effluent treatment plant for Chemical companies. Pollution control board makes sure that Indian companies are compliant with that. Chinese regulators are just waking up now.

LikeLike

Hi Jagedees,

Great analysis.

Is there a place where we can access details about the restructuring agreement with lenders?

Wanted to understand the nature of the package. Specifically if any of the debt was converted into equity (leading to equity dilution)

Thanks,

LikeLike

Thanks Rokade. I do not think details about the restructuring agreement is on public domain. My knowledge on the debt restructuring is from management’s interview and my interaction with their investor’s desk.

Nope, none of the debt from lenders are converted into equity as per FY’16 annual reports.

LikeLike

Hi Ewhwar,

Very good analysis and share the same thoughts as you do. Somewhere it is mentioned that the verdict will come out by September 17. Is this mentioned by management anywhere or just your guestimate.

Thanks

Roj

LikeLike

Thanks Roj. Management in email communication said, “We are hopeful to complete litigation by end of June or max Sept 17”. Going by the Daichii-Ranbaxy timeline, I guess it is very much possible (Give or take 1-2 months).

LikeLike

Hi Eshwar

Your take on the results

Thanks

LikeLike

Hello Sir,

Vry good analysis, covering all d history of Kiri n its current situation.There is a basic point which i think must b mentioned in above analysis .The dystar stake held

by kiri is 100% pledged as per d annual report .

LikeLike

The only feasible option available to Kiri is to force it’s JV partner to. Bring IPO and that too in India because Indian bourses will give better valuation. Otherwise getting valuation from pledged stake imay not be a good option.

LikeLike

Hi Pratik,

Can you please point to me the page number of annual report mentioned about the DyStar stake pledge? I can’t find it.

Company just undergone CDR. Hence, it is not unreasonable for the lenders to demand DyStar stake as collateral. But company is gradually paying up. Even couple of weeks ago, they revoked significant stake of Kiri Industries pledged with the lenders (Please see BSE announcement).

LikeLike

sure Sir go to pg no 73 of annual reports 2015-16 u will find details of security offered for long term borrowing n current maturity.Pledges of dystar stake is as follow:

1311677 eq shares to invent assets secuitisation & reconstruction p ltd

assets care & reconstruction ent ltd

PNB

on pari pasu basis

396320 eq shares assets care & reconstruction ent ltd

915357 ” ” invent assets secuitisation & reconstruction p ltd

Thanks for reply

LikeLike

We should question sustainability of EPS numbers (consolidated). “Extra-ordinary items” have contributed enormously. Investors will be in for a big surprise when there is “sudden” fall in EPS numbers in the next few quarters? And, who valued DYSTAR at 6000 to 7000 crores?

LikeLike

Hi Kris,

Where do you see significant “Extra-ordinary items”? As per recent changes in accounting norms, associate company revenues are not included in consolidated revenue numbers. Only net profit numbers should be reported under “Share of profit of associates”.

Valuation of DyStar is my rough estimation based on the last 2 years reported numbers (12 times the net profit of around 500 crores). Assuming 12X is not a unreasonable multiples.

LikeLike

See the latest quarterly report (Sep 30, 2016, consolidated):

EPS diluted (before extraordinary items): 7.76

EPS diluted (AFTER extraordinary items): 23.73

For the year ended Mar 31, 2016:

EPS diluted (before extraordinary items): 6.63

EPS diluted (AFTER extraordinary items): 61.88

In spite of this, KIRI is very tempting, mainly due to DYSTAR stake!

LikeLike

Dear Antinvestor,

Dystar profits that they are mentioning in Consolidated results are just on paper profits, they are not getting any money out of it i.e virtual profits.

On standalone base company is trading at a 9 times Fy17E EPS. Remember that this year they are getting benefits of higher realization on their products because of Chinese companies environmental norms issues. What if realization will correct by 30% going forward the same company will look expensive on standalone basis. so company’s valuations are very much dependent on Dyster litigation outcome.

My question is what can be possible the outcomes of this case and what can worst worst possible scenario with this case?

thanks

Prashant

LikeLiked by 1 person

http://www.scmp.com/print/news/china/article/2059329/dumping-untreated-acid-chinese-canal-highlights-nations-water-pollution

— What if there is no Dystar left ?

LikeLiked by 1 person

More questions than answers. Kiri should come out with a detailed presentation elaborating on all the aspects of the deal, including valuation of Dystar, how it can monetize its stake in Dystar and what would be the legal implications of the ongoing pollution problem at their plant in China. Until it comes out with some detailed clarification, investors would be guessing and that would not be good for the company.

LikeLike

Pingback: Kiri Industries Limited – Review on 13th March 2017

Pingback: Kiri Industries – My Path toward Value Investing

I took interest in Kiri , after the recent 2016-17 results. I looked through the old annual report and got the Dystar angle. Your blog helped me understanding the picture better and faster.

Incidentally if we omit JV profit and also adjust for warrents pending, the EPS may come to about 30.2 and the market price is reasonable now.

LikeLiked by 1 person

Why should Kiri get out of Dystar JV as they are getting decent profit. Also, last two quarter there is a note in P&L of Kiri that Longsheng is showing management fees and bonus and taking away much of the profit earned by Dystar.

LikeLike

They are minority shareholders and relationship is no longer tenable. Hence management took it court and want to encash their investments.

LikeLiked by 2 people

To my knowledge, Kiri holds 37.5% holding in Dyestar and not a significant minority holding.

And the point is not about the holding or ownership, the whole point is if Kiri wants to get out of this JV, how it can do safely, securely at a market determined price. And not be cowarded by a strong and big JV partner.

There is no answer to this basic and fundamental question.

LikeLike

Hi!

Thnx for the detailed report on Kiri.I was wondering if Dystar case could give Kiri multifold jump then why is the broader market ignoring this fact.It could be the settlement from Dystar would be just one off windfall gain and not operating revenue.Kindly let me know your views.

LikeLike

In general, Market hates uncertainty and hence until the compensation amount spelt out in Judgement, there will not be any value assigned to it. Plus there is a management perception. Standalone company’s valuation is in line with other dyestuff companies in market.

LikeLike

Excellent writeup and hardwork eeshwardevji.

Any updates from china pollution control and its effect in their production , dystar case & what are current.Prices of hacid and. Vinyl sir .

Cheers

LikeLike

Hi Amit, Thanks for the kind words 🙂

I am expecting an update on Dystar case some time in September’17 – Lets see. For other questions, refer to Shree pushkar chemicals concall which may be relevant to Kiri Industries:

1. Vinyl sulphone price in q1 FY’18 is 225-250 (Vs 275 in Q4 FY’17) and H-acid price is 325-345

2. Chinese pollution situation going back to more worst, as Chinese govt appointed new committee “CPA (Chinese pollution audit committee)” which they are conducting inspection in each and every plant and so so many illegal intermediate company are shutting down

3. According to management, there is no room for price go down from here due to chinese crackdown.

LikeLike

Yes thats i have seen in vakuepickr….nice updates on the situation.

Keep doing this brillaint work.

I can hold kiri for 2 years easily…hope speciality chemical as a wholle give some nice rerurns ….chemcials it can be a sector for next 5_10 years provided china crackdown on pollution goes as expected

Thnks

LikeLiked by 1 person

As Kiri is a 37.5% (minority shareholder) in the Dyestar JV, it has gone to Singapore court for getting out of the JV.

Court can decide on the way forward for getting out of the JV. But the moot question still remains whether a Singapore Court would give a valuation to the JV?

People have doubt whether the Court would give a fair valuation to the JV as desired by Kiri.

The whole problem is myopic thinking on the part of Kiri management who did not envisage the ‘exit’ strategy and option from this JV.

Of course, Chinese crack down on the polluting industries is going to be hugely beneficial for companies like Kiri, but, how they can make money out of this JV/game is yet to be seen.

LikeLike

Yes sir many things are still need clarity going ahead. Dyestar is one if the main catalsyt going ahead.

But the thing is on standalone basis kiri looks good with TTM of 34/-..trading at 8 5 PE only……what u say?

And above that huge debt reduction has taken place whichbgive added safety maegin and confidence to investors…co has now no need to pay huge interests now….

This sector if keep booming will be rerated to higher P..E with rising eps.

Thanks

LikeLike

Stellar Q1 numbers by kiri.

Pl have a look …would love to hear from u sir.

And happy ganesh chathurthi.

Thanks

LikeLike

Kiri result out:Fantastic

Beat both qoq and yoy..

Standalone NP:

30.36 CR Vs 26.13CR(YOY) Vs 25.44(QOQ)

Consolidated NP:

103CR VS 81 CR (YOY) Vs 63CR (QOQ) ( 1 min ago )

LikeLike

Happy Ganesh Chathurthi 🙂

My notes on Q1 FY’18:

1. Revenues dropped by 7.5% (Sort of expected due to GST destocking and textile strike)

2. Operating profit increased by 12% (Principally due to reduced interest cost)

3. Interest cost fell from 2.79 crores to 99 lakhs indicating healthy repayment (next quarter balance sheet will tell us the quantum of repayment)

4. DyStar performance is very encouraging. Revenue increased by 10% and profit jumped by 40%.

5. Q3 and Q4 were muted for Dystar due to some dispute regarding performance bonus paid. It is good to see that its profits are back to normal.

LikeLike

Excellent analysis as well as follow-up discussions on the company. I was just reading the annual report and found that Kiri has another JV with Longsheng group in India where it holds 40% stake… Won’t the Singapore Court ruling affect this relationship in India?

LikeLike

Thanks 🙂 I had the same doubt. Since JV contribution is substantial, I contacted the company officials. They gave standard reply that Indian JV is out of the current dispute in Singapore court on DyStar – so no impact. Nevertheless, it is a risk for sure – but I hope it would be resolved amicably.

LikeLike

that can also be settled ..in singapore lonseng can buy kiris stake in dystar…and from that money kiri can but lonseng stake in india…

LikeLike

Yes, highly possible.

LikeLike

Yes thats a better option both can buy each others stake and that will be good use of money too by kiri…but biggest question still remains the when trial dates be fixed and hearing begins..that will test investors pateince for sure…

Also any updates on v sulphone and hacid prices..heard theh have risen by 10% in Q2. Pl do confirm from ur sources.

Also kiri hit a new multiyear high yesterday..thats a big relief.

Thanks

LikeLiked by 1 person

https://www.reuters.com/article/us-china-refinery-relocation/china-to-move-chemical-plants-out-of-populous-urban-regions-idUSKCN1BF1BF

LikeLiked by 1 person

Hello sir…

R u attending Agm? Or any close friends of yours?

Regards

LikeLike

I am not attending Kiri Industries AGM. I will ask my friends. Please keep me posted if you come across any notes regarding AGM meeting.

LikeLike

sure sir.

LikeLike

The Singapore court has taken up the Kiri case today for hearing ie on 10th sep 17 as per court proceeding calender. Do you have any update on the same? By when we can expect a result on the case?

LikeLike

I didn’t know that. Any links for the same?

Management indicated that once it comes for hearing, final judgement will be pronounced in 45-60 days based on Singapore Arbitration Courts past track record. Please keep me posted if you come across news source/web links regarding this.

LikeLike

Verdict is on October 26, 2017

LikeLike

Any links for the same?

LikeLike

No link; but the source is most reliable

LikeLike

Hello basheer ji…but how can source tell the date of verdict..??until and unless judge himslef tells that verdict will be on so and so date…

Just a single and 1st hearing happened on 9th oct

LikeLike

Management indicated that once the case comes up for hearing (which takes 18-24 months), final judgement will come in 45-60 days maximum. This estimation is based on the track record of Singapore arbitration court.

LikeLike

What is that source?

LikeLike

Go to this Singapore Supreme Court portal – https://www.supremecourt.gov.sg/hearing/hearing-list – Select ‘This Week’ hearing and check under Judge Kannan Ramesh.

LikeLike

Hi sir

Kiri SHP out.entry of one more fund house.

APMS INVESTMENT FUND BOUGHT 3.70 lakh shares in Q2.

Dystar hearing started already may be settled bh dec jan at maximum.

Rocking times ahead.

Also hacid n vinyl sulohone prices were robust in Q2 .expecting strong numbers by all soeciality chemical players

Cheers

LikeLiked by 1 person

hi jagdeesh sir how r u.

Sir did u connected with managment after 1st case hearing …whats your feel..i am nervous now what will be the outcome (in a 2-3 months may be) and how stock will react….

is anything negative expected??i belive kiri hardships are genuine and court may give decision accordingly and hopefully no negative surprise too come.SHP also indicating that as no of retail shareholders reduced drastically means strong hand accumulating..

Also what about hacid and sulphone prices heard they are rising again but no concrete source….one thing i know is that Q2 prices were quite robust than Q1 so expecting good numbers by all spec chemicaal cos ..further winter cuts expected from CHINA.

super exciting and thrilling times ahead…

Regards

LikeLike

Dear Investors, Any updates on Dystar case hearing?

LikeLike

No idea but the way in which the stock is galloping, it seems that the verdict has been in favour of Kiri.

LikeLike

Hearing has started..not the verdicthas given .verdift will come in nov end or decembde

LikeLike

Sir Warrant convesrion happeing now…whats your view on that ….how that will change the kiri and balance sheet n all.

LikeLike

any update on result??

LikeLike

Any update on Dystar Trials in Singapore court. There was a trial happened today 11-Jan-2018, Another hearing on 12-Jan-2018. Subsequent hearings on 15,16-Jan-2018.

https://www.supremecourt.gov.sg/hearing/hearing-list Judge: Kannan Ramesh Type of trial SICC

LikeLike

I wonder how shares of Kiri Industries have sky rocketed by more than Rs. 650 even when the trial is undergoing at Singapore court pending any decision.

LikeLike

My understanding from various news about Singaport court SICC, once the trial and witness hearing started, soon may be in a month time the Judgement to be expected. Given that Kiri expect very positive outcome of verdict in favor. Either Longsheng has to buy Kiri stake or filing DyStar for IPO or if any other means someone mentioned Longsheng can sell indian Lonsen Kiri stake to Kiri and Kiri can sell corresponding equivalent amount of state in Dystar to Longsheng anything possible.

Any news about the possible verdict? Stock market reacting to this and price shoots up to 640 at this price PE = 6.6 consolidated basic. If judgement in favor, expect Kiri industries PE to touch 15.

LikeLike

Even assuming the decision is in favour of Kiri, but, the decision would increase the ‘ownership holding’ of Kiri into DyStar or it would give an opportunity to monetise the DyStar investment increasing its cash flow.

Other than that, there is not going to be a permanent increase in the profitability of Kiri. The perplexing thing is that whether the increased current price of Rs. 640 is justifiable or not.

LikeLike

Pingback: A very fine article – – sharmadeepakk

Hello Investors, Did anyone know when is the final judgement date for the trial?

LikeLike

Hi Do anyone have info about the possible final judgement date of verdict in dystar case?

LikeLike

Head I Win – Result Out.

LikeLike

hello can any one through some light on ongoing situation please

LikeLike