Unlike manufacturing companies, capital is the raw material for financial institutions. Banks periodically raise capital by issuing new shares via rights issue, QIP etc. to support their future growth. Hence, for existing shareholders, equity dilution is one of the important factor that impacts his/her future returns. In addition, Equity stock option (ESOPs) to the top management is another important factor that dilutes investor returns. Check out the difference in CAGR returns between net profit growth and Earnings per share for some of the best-performing private sector banks. On average, 3-5% impact on the returns can be seen.

RBL Bank was kind of outlier – I convinced myself that this could be due to the huge capital raised by the new management to support their high-growth phase (Before IPO, they raised capital from marquee investors via multiple private placement of shares). However, following figure from Motilal Oswal research report intrigued me:

High-powered Incentives:

High-powered Incentives:

Around the world, the behaviour of the management teams usually responds to financial incentives. It is one of the most powerful concept in behavioral economics. Charlie Munger stressed that one should always think about the power of incentives. He famously quipped, “Show me the incentive and I will show you the outcome”. In recent times, ESOPs issuance by Indian private sector banks emerged as an most important component of management compensation and retention tool. It was pioneered by HDFC bank and over the time, most private banks followed the suit.

Check out the following two passages on incentives:

[Source: Morgan Housel’s post titled “The Double-Edge Sword of Incentives“]

Source: Ajay Shah’s post on “High-powered incentives in banks“

Opaque accounting practices in financial sector:

Complex accounting practices of financial sector places enormous power in the hands of the senior management in terms of what kind of information to disclose in financial statements. There are many instances in India where opaque accounting and senior management’s aggressive loan growth strategy leading to near-term bank profits that could boost the stock price today but damage the business few years down the line.

- Read Livemint story on the aggressive lending of Indian Overseas Bank

- Read Outlook business story on wholesale banking business troubles of Standard Chartered bank in India

In the year 2013, ambit capital came out with a thematic report on aggressive accounting policies followed by Indian companies. It flagged following two accounting practices regarding private sector banks:

I. Cost of ESOPs [basically management compensation cost] is not expensed in the bank’s P&L statement using a proper valuation method and hence boosting bank’s profitability. It further noted that if ESOPs are properly expensed, it would shave off 10bps from ROAs of these banks.

II. Fee income accounting: Fee income constitutes significant portion of private bank’s operating revenues. While the interest paid by borrower accrues over the duration of the asset, the fee income is often booked upfront by some of the banks, thus bloating the earnings. Check out the following example from the report:

RBL bank and ESOPs:

Annual reports does not provide much info regarding fee income accounting. However, there is fair amount of disclosure on ESOPs and its impact of bank’s profitability.

[Source: Annual report FY’16]

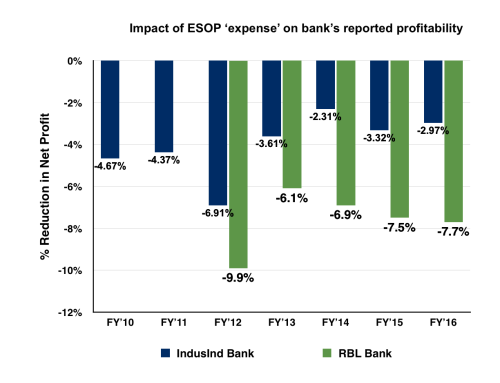

I looked up info on ESOPs impact on profitability from previous annual reports and compared with the IndusInd bank [Where MNC executives took over the bank’s top management in 2008].

Bottomline impact is consistently on the higher side. I also looked at the outstanding options at the end of FY’16 and compared it to total equity base. It shows the prospect of significant equity dilution going forward when compared to other private banks.

I have high regards for the senior management of RBL bank for turning sleepy co-operative bank into new-age private sector bank. Its IPO was well-marketed. But i feel, the compensation structure is bit unfair to the equity shareholders of the bank. I agree that ESOPs across the management structure could instill a sense of ownership and motivates them to strive for better organization. However, this high-powered incentives has the potential to act as a distraction for the management to build a robust financial firm.

P.S. I have a friendly bet against RBL bank with a friend initiated on October 1st, 2016. I wagered that DCB Bank will outperform on a 3-year term basis when compared to RBL bank. My bet was purely based on the valuation when compared to its CASA deposits, return ratios, loan book basis etc. I still believe that if management executes quality growth, it can outperform most private banks on a 7/10 year horizon. However, I would like to keep a close eye on the behavior of the management.

P.P.S. Why does the bank schedule so many analyst meet? Almost like an daily affair 🙂

Disclaimer: Please note that this is my investment journal. The main aim is to expose my investment thoughts to the scrutiny of fellow investors and improve the process thereby. It shall not be construed as an advise to buy/sell the stock.

Well put research note Eeswar. It is best to factor in the future dilution in present and future earnings, in RBL’s case ~10%, while valuing any company that has ESOPs. If the valuations are still attractive it should mitigate the risk. What do you think?

LikeLike

Ha ha!! As they say, make hay while the Sun shines.

But nice analysis. Hoping that investors and other analysts would look into it. However, if the Bank can keep on earning more, the cost of such ESOP would come down on a relative basis from valuation perspective.

Good great.

LikeLike

A most candid chapter on ESOP and Equity Dilution and its impact on CAGR.RBL is now a days one of the most touted pvt. bank to be in.But like you I believe given the Aga Khan Foundation’s strong background that pulled up a bank like HDFC, DCB can emerge as a clear winner if the management do not indulge in any irrational decision.

LikeLike

Is this comment on DCB or RBL?

LikeLike

Most of the members of RBL top mgmt are in the last lap of their career , especially those who have worked with MNC banks, sans the lottery ESOPs. Hence, it is quite possible they will max out their ESOP, so your concern is quite valid.

LikeLiked by 1 person

Great

LikeLike

Nice write up Eeswar.one question though: If management puts up a proper risk control/risk management in place with strict KYC norms before lending and if the employees had to follow the policy to make sure they are lending it to the creditworthy people,will it be enough to offset the ESOPs incentives?

End of the day,if the lending practises are roubust enough,you would be better off in this business?

LikeLike

Agree that if lending practices are robust enough, it is better for business. But history have shown that excess incentives most of the time leads to loose lending practices. Lets see how RBL executes.

LikeLiked by 2 people